belushiiwuzeree

ABOUT DIGITAL TICKS

Digital ticks trade group believes in a sturdy technology , It is a first crypto exchange commodity designed by pedagan and for traders. Digital Ticks Exchange is not just a crypto exchanger but also its own semi-algorithm platform provider. Digital ticks exchange would have devoted marketplace makers who would possibly provide non-stop depth and liquidity inside the market.

DTX will be a power packed by many advanced features including all the basic features of an exchange required by a novice trader for a professional trader.

DTX makes extra precautions to avoid all kinds of hacking such as DDoS attacks, phishing attempts, and perform vulnerability assessment and penetration testing. DTX has been applied with a powerful behind-the-scenes technology that can handle heavy volatility in the crypto market as well as commodity markets that can handle up to 1,000,000 transactions per second. Digital Ticks Exchange will not charge any transaction fees for the first few months from the beginning so give traders to trade on zero transaction fees. DTX will provide volume based incentives for high frequency traders (HFT) that will give them room to maintain higher profitability in trading.

EXPLORING DIGITAL TICKS

FEATURES OF DIGITAL TICKS PLATFORM

Spot Trading – Only trading cryptocurrency, I actually had to look this up, since this isn’t a common term for me. “A spot trade is the purchase or sale of a foreign currency, financial instrument or commodity for immediate delivery. Most spot contracts include physical delivery of the currency, commodity or instrument; the difference in price of a future or forward contract versus a spot contract takes into account the time value of the payment, based on interest rates and time to maturity” – Investopedia.com This might be an answer to how the Commodity-Crypto pair works from above. This will be updated once I confirm or deny this information.

Crypto – Crypto Currency Pair – This one’s pretty straight forward, it will offer what typical crypto exchanges offer, which is crypto to crypto pairings: nothing to see here.

Commodity – Crypto Pair – Probably the difference maker for the exchange. Will Support BTC, ETH, LTC, NEO, DTX, Gold, and Silver right away. It doesn’t really describe in the white paper what will be involved with trading commodities specifically which would have been a nice inclusion, but I’m sure specifics will become more clear moving closer to beta.

Futures – Futures prices are an agreement between a buyer and a seller to exchange goods at a future date. In Crypto this can be for any future price of a token or things such as forks that aren’t even in existence yet until a future block is mined. Futures trading is used quite often by Wall Street Hedge fund managers, and will bring a different type of liquidity as compared to everyday crypto or gold traders.

Security specific Features

Multi-sig wallet, 2FA Authentication, DDoS Protection – all pretty standard features of larger exchanges in 2018, but it’s nice to see they will be there out of the box.

Decentralized On-Chain Exchange – Blockchain verification for data, security, etc. This one is a no brainer and a very vital feature .

Cold Storage – “Cold storage in the context of Bitcoin refers to keeping a reserve of Bitcoins offline. This is often a necessary security precaution, especially dealing with large amounts of Bitcoin. ” -Digital Ticks Whitepaper This is really cool, and something I would want to see with all exchanges going forward. It’s just the smart thing to do, even if at times it leads to an hour or two of not having access to funds. Security of funds is such a big issue because most people leave far too great amounts on an exchange where it is at risk or end up trying to manage their wallet themselves without a cold wallet and end up being at more risk. This may be a perfect solution that will protect most funds from a large scale attack.

Trading specific features

One Million TPS – You read that right, one million transactions per second will be possible with this project. Really cool considering their road map is predicting over 1000 trading pairs (wow, wouldn’t that be cool? lol) One of my biggest gripes with some of the larger cryptocurrency exchanges is just the general lag during bull runs because the hardware simply cannot handle the volume. I’ve lost quite a lot of money because of crashes over the years due to not being able to place an order or sell an order at an inopportune time, so the speed is pretty important feature for me.

OCO (One cancels the other) Order – “Trader can place a square off order as well as the stop loss order simultaneously on the exchange and as soon as either of the order gets hit another order would automatically get cancelled, thereby provide trader with an ease of doing trading. ” -Digital Ticks Whitepaper This feature is something I wish all exchanges had. Square off orders are typically a day trader stock market term that basically means buy a certain amount of shares and then later that day sell the shares automatically in hopes of gaining a profit. Not sure how this works with a market that never closes, but maybe its just a philosophy of a day trade by a specific amount of open time left up to the trader. Still though it basically just sounds like a stop limit as a stop loss and a stop limit desirable price can be set simultaneously with the same stack. This would be quite useful, so you don’t have to rely on things like trailing stops so heavily.

Single Click Portfolio View – Simple as it sounds, a detailed view of your portfolio with a single click. It says in the description that multiple instruments will be included (futures) so maybe it will give a breakdown of what is a coin you own, what is a future you own, and when will the deal actualize. I would like to see multiple breakdowns of BTC/USD at the click of one button and would like to see a feature like time machine trades (how this trade is doing vs just staying in BTC or ETH in the past. Another nice opportunity here would be to show past charts for specific tokens or past commodity charts with historical pricing since before the exchange went live.

Hot keys –As a big time gamer and film editor, I would love to bring the power of hotkeys to my trading. Certain tasks are just way too many key presses or mouse movements, and I think this is a huge opportunity to set a new standard here. It doesn’t really state whether the hotkeys will just represent one step tasks or record-able macros, but I think this would be brilliant if it allowed this level of customization. Still even basic hotkeys is a huge step forward when you’re potentially doing similar tasks thousands of times a month.

TOKEN AND ICO DETAILS

Name: DTX

Platform Token: Ethereum ERC 20

Purchase Method: BTC / ETH

Token Type: Utility

Sales Period: 25.03.2018 -14.04.2018

Selling Price: 1DTX = 0,30USD

Public Sale Period: 15.04.2018 -15.05.2018

Public Sales Token Price1DTX = 0.375-0,700 USD

Soft Cap: USD 5.7 Million

Hard Cap: USD 30 Million

Unsold tokens will be burned after the Token sale expires

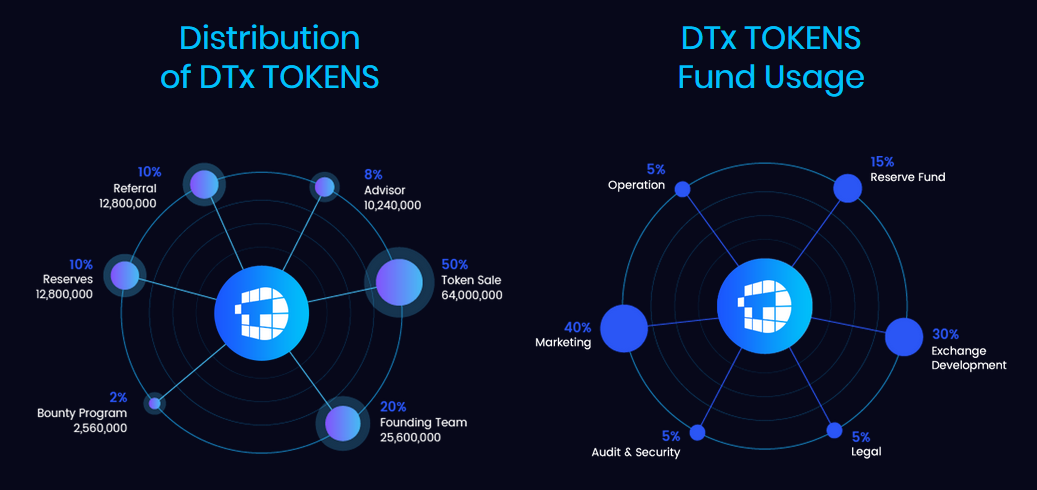

TOKEN DISTRIBUTION AND USAGE OF FUND

Token Allocation

TOKEN SALE 50% 64,000,000

FOUNDING TEAM 20% 25,600,000

RESERVES 10% 12,800,000

REFERRAL 10% 12,800,000

ADVISOR 8% 10,240,000

BOUNTY PROGRAM 2% 2,560,000

Max Supply of Coins: 128,000,000

DTX TOKENS USING REPURCHASING PLAN DTX tokens will be used to pay fees on our platform, including but not limited to:

Exchange trading costs

Discount Discount Based Incentives

Withdrawal Fees

Fees Applicable

Additional functions such as research reports, statistical calculations

Strategic Investment by beneficiary members of the exchange

CHALLENGES OF CUTTING-EDGE CRYPTO FOREX

• Loss of liquidity

Digital ticks exchange would have devoted marketplace makers who would possibly provide non-stop depth and liquidity inside the market. Lack of liquidity is a issue for all of the traders inside the marketplace because it will growth the impact fee/fee of funding while shopping for and selling and makes it difficult for them to alternate. Digital ticks trade group has a decade of market making enjoy in worldwide financial derivatives marketplace. This majorly happens due to the fact now not many people are searching for and selling property on the trade thereby developing a skinny intensity in the marketplace.

• Inefficient customer service

To cater to the identical digital ticks alternate crew has built up a dedicated customer service oriented crew who could be prepared to clear up the queries of the supplier on the skip. Digital ticks trade team is acquainted with the dealer attitude wherein each nano-2d of buying and selling is crucial. Whilst coping with such large amount of finances it becomes essential to have a collection of experts to remedy patron queries. Transport of customer service can be very slow, they don’t even reply to queries for days, lengthy withdrawal times, login troubles and budget locked into the trade with nobody to manual for the

• Security

Digital ticks change crew ensures that the security tool will go through continuous development, everyday it protection and economic audits. Digital ticks exchange crew may want to perform vulnerability scans & checks, security tests and penetration attempting out. Those protection issues make deposits into those exchanges unsecured. Cryptocurrency exchanges that convey patron’s rate range in huge quantity have become a goal for hackers and internal frauds

• Llatency trouble

For the identical digital ticks trade crew might offer sturdy generation in place and is committed to improve the identical every now and then. Digital ticks change team has over a decade of buying and selling enjoy and is conscious the charge volatility in crypto international. If their is a moderate postpone within the update of price then a dealer can face heavy losses. Growth in new registrations, unexpected spike in volumes, beside the factor infrastructure, risky connection exceptional and exchanges accomplishing its limits in terms of order in step with 2d consequences into latency problems

• Downtime

For the same virtual ticks alternate group would possibly offer strong technology in region and is devoted to enhance the equal from time to time. Digital ticks exchange group has over a decade of buying and selling experience and is aware the rate volatility in crypto worldwide. If their is a slight dispose of in the replace of rate then a trader can face heavy losses. Increase in new registrations, unexpected spike in volumes, inappropriate infrastructure, volatile connection incredible and exchanges reaching its limits in phrases of order consistent with 2nd effects into latency issues

ROADMAP

Below, you can see the road map and how the team sees their nearest and long-term future.

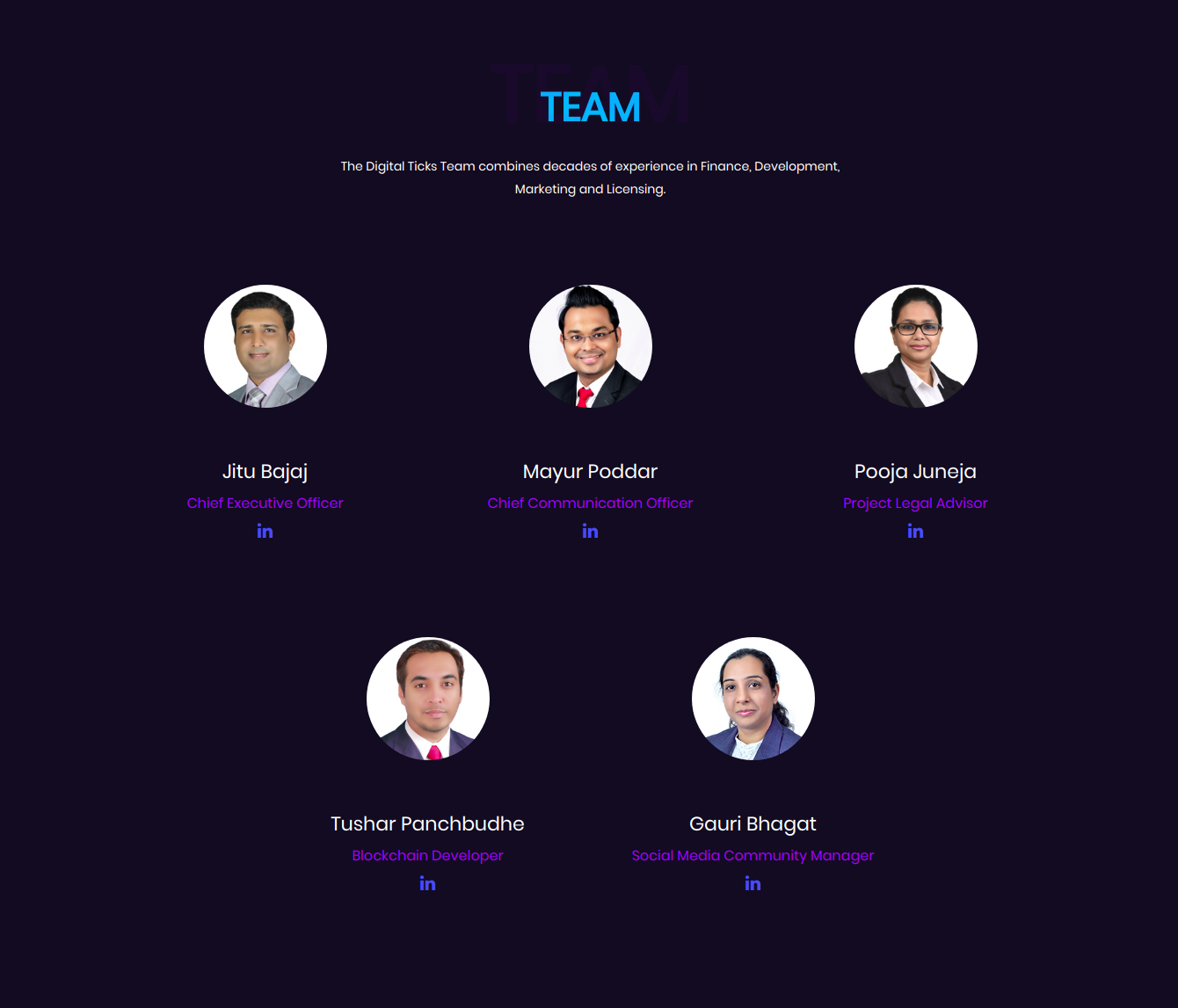

TEAM

Resources on Digital ticks are requests of magnitude more secure than they are anyplace else. We are talking flexible offline cold storage. This fundamentally meaning we should leave “stressing over your cash being inside a trade” behind us. This is a noteworthy security overhaul, I may even be obliged to state that using cold storage is a standout amongst the most fascinating highlights we are right now taking a gander at in any trade. We as a whole need protection that our cash is 100% safe and now we have it. Put away disconnected, outer dangers are not any more an issue like they used to be. With Digital ticks we are talking unhackable cold storage, however with adaptable access. Like a gourmet specialist going from solidified to defrosted in a flash. Simply consider what this implies.

Be a part of this tremendous project and follow these links for more information;

Website: https://www.digitalticks.com/

Twitter: https://twitter.com/digitalticks

Medium: https://medium.com/@digitalticks

Telegram: https://t.me/digitalticksexchange

Author

belushiiwuzeree

BITCOINTALK PROFILE

No comments:

Post a Comment